Professional Investing

Made Simple

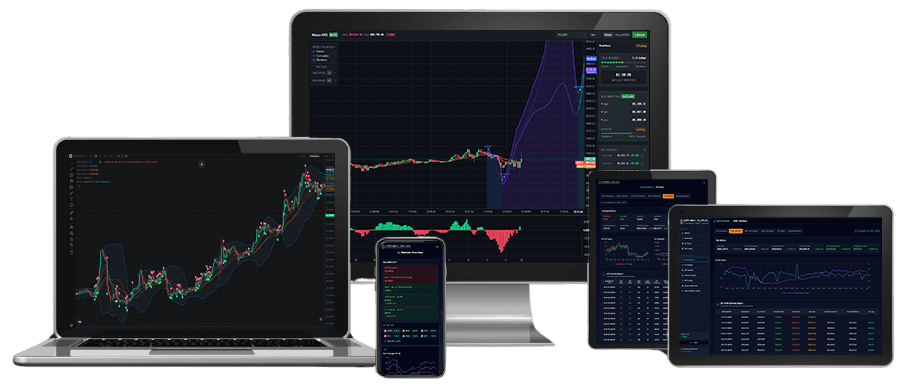

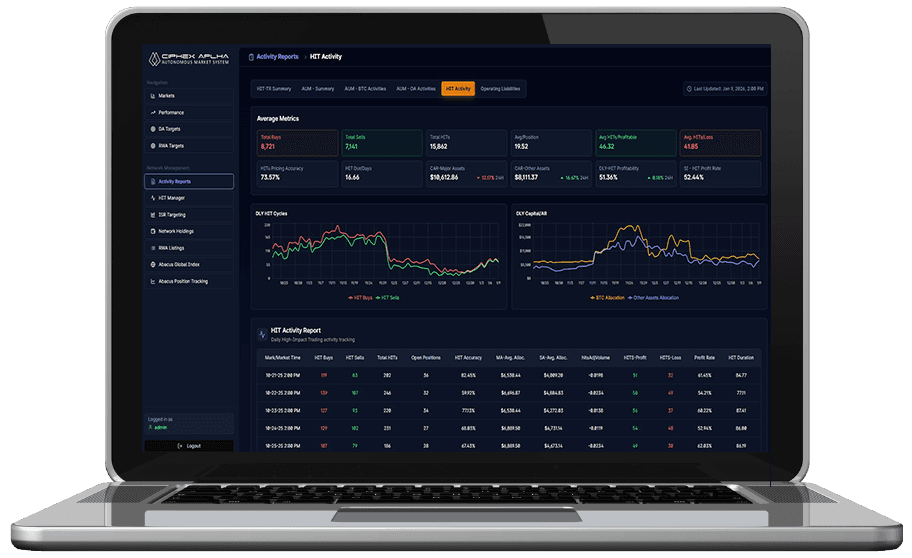

CipheX Alpha delivers professional investment intelligence through a simple, automated experience designed for everyday users, without added complexity.

Professional Investing

Made Simple

CipheX Alpha delivers professional investment intelligence through a simple, automated experience designed for everyday users, without added complexity.

Professional Investing

Made Simple

CipheX Alpha delivers professional investment intelligence through a simple, automated experience designed for everyday users, without added complexity.

CipheX Alpha is currently in precommercial testing and is not available to the general public. Commercial availability will be subject to applicable securities laws and regulations, and availability may be restricted or prohibited in certain jurisdictions.

CipheX Alpha is currently in precommercial testing and is not available to the general public. Commercial availability will be subject to applicable securities laws and regulations, and availability may be restricted or prohibited in certain jurisdictions.

CipheX Alpha is currently in precommercial testing and is not available to the general public. Commercial availability will be subject to applicable securities laws and regulations, and availability may be restricted or prohibited in certain jurisdictions.

Closing the Experience Gap

Closing the Experience Gap

Closing the Experience Gap

The digital asset market has matured into a high-velocity, globally integrated environment where execution, not access, defines competitive advantage. With rising complexity, heightened volatility, and increasingly narrow opportunity windows, conventional portfolio strategies are proving inadequate. In today’s 24/7 global market, sustained performance depends on executing with speed, strategic clarity, and precision.

Modern markets continue to evolve at an increasing speed. While consumer trading tools and self-directed portfolio platforms are widely available, most emphasize transaction activity rather than decision guidance and execution support. Many users also lack the time or experience required to manage their portfolios effectively. CipheX Alpha closes that gap by removing complexity and manual decision-making with automation driven by experience and strategies built for continuously changing global markets.

Modern markets continue to evolve at an increasing speed. While consumer trading tools and self-directed portfolio platforms are widely available, most emphasize transaction activity rather than decision guidance and execution support. Many users also lack the time or experience required to manage their portfolios effectively. CipheX Alpha closes that gap by removing complexity and manual decision-making with automation driven by experience and strategies built for continuously changing global markets.

Modern markets continue to evolve at an increasing speed. While consumer trading tools and self-directed portfolio platforms are widely available, most emphasize transaction activity rather than decision guidance and execution support. Many users also lack the time or experience required to manage their portfolios effectively. CipheX Alpha closes that gap by removing complexity and manual decision-making with automation driven by experience and strategies built for continuously changing global markets.

Designed for Simplicity

Designed for Simplicity

Designed for Simplicity

Alpha CPX preserves full user control while eliminating the inefficiencies of traditional portfolio management, human intermediaries, rigid fee structures, and biased execution. Powered by its proprietary CPX Targeting Framework, this non-custodial, self-directed system delivers autonomous, high-speed trading with institutional-grade performance, engineered to outperform both traditional managers and conventional self-directed platforms.

CipheX Alpha is engineered to operate autonomously with no manual trading required. It specializes in short-duration market opportunities, executing systematically through defined, process-driven frameworks that significantly reduce human intervention and eliminate emotion-driven execution risk. The result is a streamlined experience where users are not required to monitor markets, make constant decisions, or manage execution complexity.

CipheX Alpha is engineered to operate autonomously with no manual trading required. It specializes in short-duration market opportunities, executing systematically through defined, process-driven frameworks that significantly reduce human intervention and eliminate emotion-driven execution risk. The result is a streamlined experience where users are not required to monitor markets, make constant decisions, or manage execution complexity.

CipheX Alpha is engineered to operate autonomously with no manual trading required. It specializes in short-duration market opportunities, executing systematically through defined, process-driven frameworks that significantly reduce human intervention and eliminate emotion-driven execution risk. The result is a streamlined experience where users are not required to monitor markets, make constant decisions, or manage execution complexity.

Built to Adapt as Markets Change

Built to Adapt as Markets Change

Built to Adapt as Markets Change

Structured Targeting and Execution

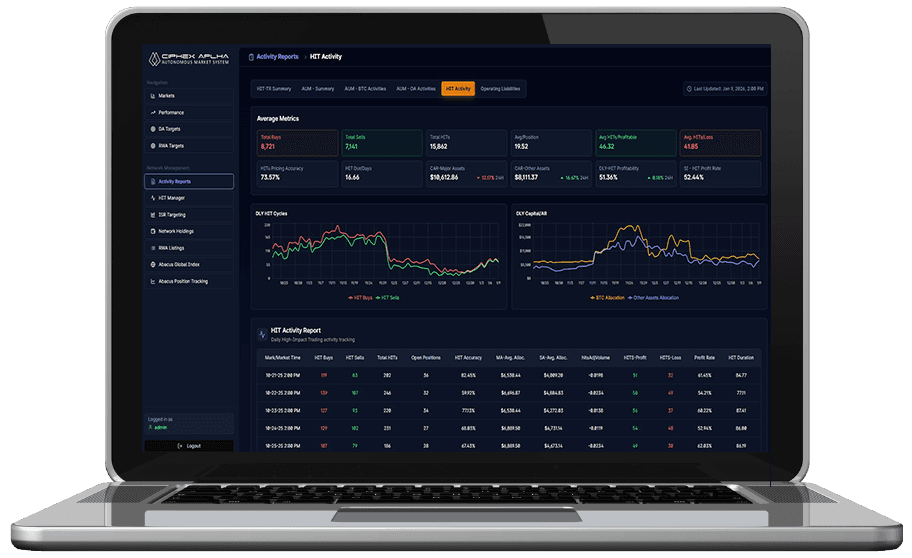

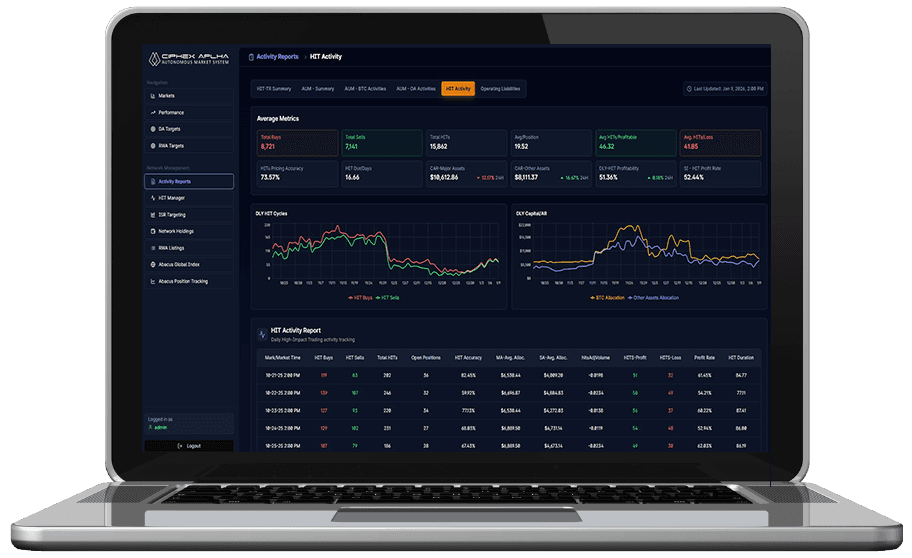

Built on the proprietary Abacus I AMS/EMS architecture, the system evaluates price dynamics and market inefficiencies across a broad digital asset universe. Disciplined analysis and repeatable execution are applied across short-duration time horizons, converting continuous market shifts into consistent, probability-driven outcomes.

Structured Targeting and Execution

Built on the proprietary Abacus I AMS/EMS architecture, the system evaluates price dynamics and market inefficiencies across a broad digital asset universe. Disciplined analysis and repeatable execution are applied across short-duration time horizons, converting continuous market shifts into consistent, probability-driven outcomes.

Structured Targeting and Execution

Built on the proprietary Abacus I AMS/EMS architecture, the system evaluates price dynamics and market inefficiencies across a broad digital asset universe. Disciplined analysis and repeatable execution are applied across short-duration time horizons, converting continuous market shifts into consistent, probability-driven outcomes.

Adaptive Capital Allocation

The system identifies multiple targets simultaneously and applies execution strategies tailored to each. Capital at risk is systematically calibrated at entry using macro- and micro-level rule sets specific to each target, ensuring alignment between opportunity structure and capital allocation discipline.

Adaptive Capital Allocation

The system identifies multiple targets simultaneously and applies execution strategies tailored to each. Capital at risk is systematically calibrated at entry using macro- and micro-level rule sets specific to each target, ensuring alignment between opportunity structure and capital allocation discipline.

Adaptive Capital Allocation

The system identifies multiple targets simultaneously and applies execution strategies tailored to each. Capital at risk is systematically calibrated at entry using macro- and micro-level rule sets specific to each target, ensuring alignment between opportunity structure and capital allocation discipline.

Responsive Risk Management

During adverse or rapidly changing market conditions, the system prioritizes capital preservation by automatically adjusting execution through de-risking actions, defensive exposure shifts, and intentional beta control. This approach supports stronger, more consistent loss containment and improved downside resilience across active strategies.

Responsive Risk Management

During adverse or rapidly changing market conditions, the system prioritizes capital preservation by automatically adjusting execution through de-risking actions, defensive exposure shifts, and intentional beta control. This approach supports stronger, more consistent loss containment and improved downside resilience across active strategies.

Responsive Risk Management

During adverse or rapidly changing market conditions, the system prioritizes capital preservation by automatically adjusting execution through de-risking actions, defensive exposure shifts, and intentional beta control. This approach supports stronger, more consistent loss containment and improved downside resilience across active strategies.

Designed for Confidence and Control

Designed for Confidence and Control

Designed for Confidence and Control

Built on principles of security and transparency, the system operates reliably across increasingly complex digital markets, including digital assets and tokenized real-world assets, while keeping asset ownership in users' hands. As market conditions evolve and traditional financial structures continue to change, CipheX Alpha supports a more independent way for individuals to confidently manage and expand their portfolios across a growing range of digital asset classes.

Built on principles of security and transparency, the system operates reliably across increasingly complex digital markets, including digital assets and tokenized real-world assets, while keeping asset ownership in users' hands. As market conditions evolve and traditional financial structures continue to change, CipheX Alpha supports a more independent way for individuals to confidently manage and expand their portfolios across a growing range of digital asset classes.

Built on principles of security and transparency, the system operates reliably across increasingly complex digital markets, including digital assets and tokenized real-world assets, while keeping asset ownership in users' hands. As market conditions evolve and traditional financial structures continue to change, CipheX Alpha supports a more independent way for individuals to confidently manage and expand their portfolios across a growing range of digital asset classes.

Execution Roadmap

Execution Roadmap

Execution Roadmap

A structured path from development to commercial deployment

A structured path from development to commercial deployment

Technical Audits

Completed

PHASE 1 EY2025

Internal CipheX-HITs Testing

Completed

PHASE 2 TARGET- EY2025

Introduce RWA Services

PHASE 3 TARGET- EY2026

Limited Public Presale

Completed

PHASE 1 EY2025

Complete View Only Platform

Completed

PHASE 2 TARGET- EY2025

Open CipheX Alpha Retail

PHASE 3 TARGET- EY2026

Expand AI CPX Development

Completed

PHASE 1 EY2025

Initial DEX Listing

In Progress

PHASE 2 TARGET- Q12026

Initial CEX Listing

PHASE 3 TARGET- EY2026

Technical Audits

Completed

PHASE 1 EY2025

Expand AI CPX Development

Completed

PHASE 1 EY2025

Open CipheX Alpha Retail

PHASE 3 TARGET- EY2026

Limited Public Presale

Completed

PHASE 1 EY2025

Internal CipheX-HITs Testing

Completed

PHASE 2 TARGET- EY2025

Introduce RWA Services

PHASE 3 TARGET- EY2026

Complete View Only Platform

Completed

PHASE 2 TARGET- EY2025

Initial DEX Listing

In Progress

PHASE 2 TARGET- Q12026

Initial CEX Listing

PHASE 3 TARGET- EY2026

Technical Audits

Completed

PHASE 1 EY2025

Limited Public Presale

Completed

PHASE 1 EY2025

Complete View Only Platform

Completed

PHASE 2 TARGET- EY2025

Expand AI CPX Development

Completed

PHASE 1 EY2025

Internal CipheX HITs Testing

Completed

PHASE 2 TARGET- EY2025

Initial DEX Listing

In Progress

PHASE 2 TARGET- Q12026

Open CipheX Alpha Retail

PHASE 3 TARGET- EY2026

Introduce RWA Services

PHASE 3 TARGET- EY2026

Initial CEX Listing

PHASE 3 TARGET- EY2026

Perspectives that Built Our Architecture

Perspectives that Built Our Architecture

Perspectives that Built Our Architecture

Direct insights from expert contributors on the intelligence, framework, and governance behind Alpha CPX.

Direct insights from expert contributors on the intelligence, framework, and governance behind Alpha CPX.

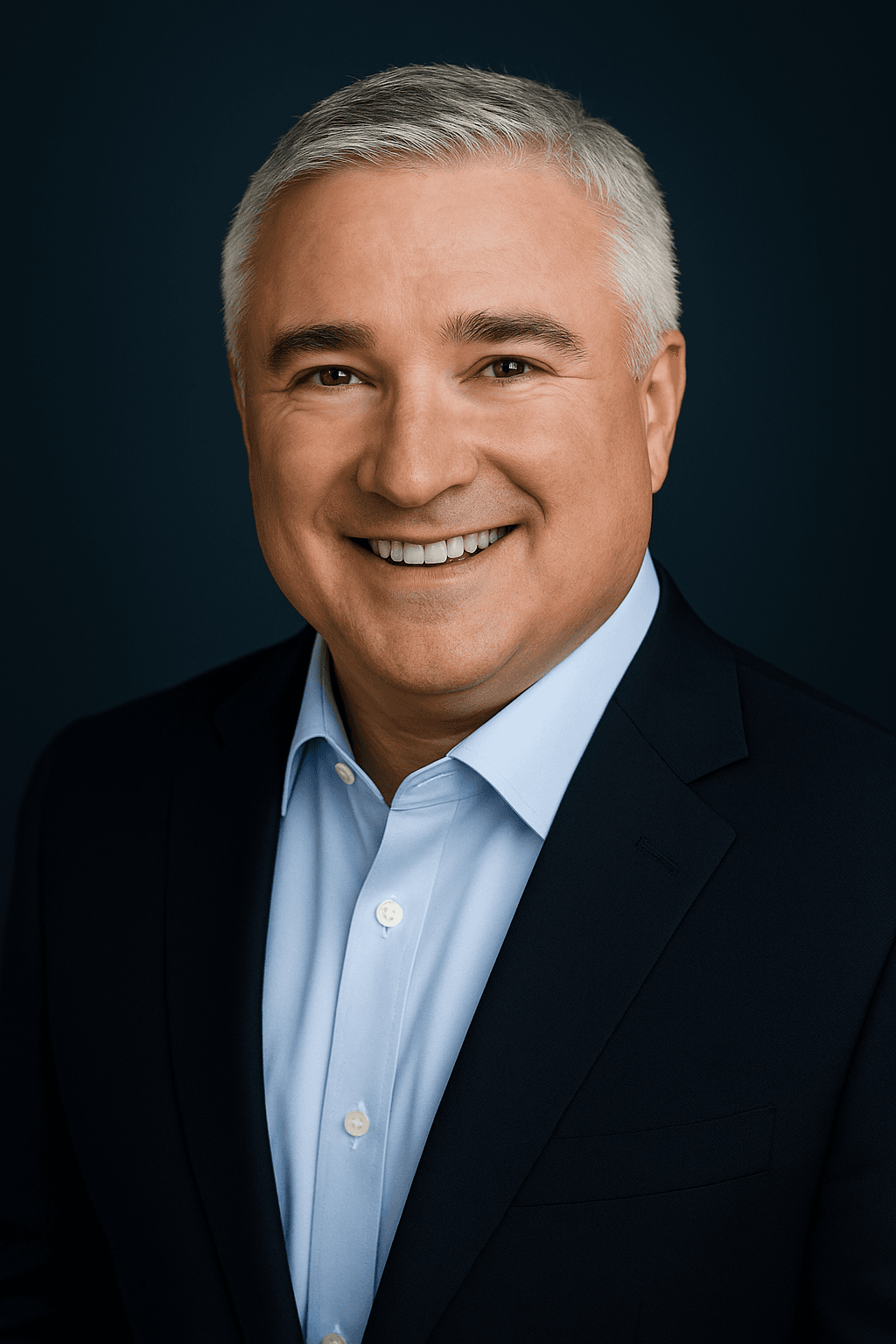

Leadership & Expert Contributors

Leadership & Expert Contributors

Leadership & Expert Contributors

A Proven Track Record in Finance, Innovation, and Execution

A Proven Track Record in Finance, Innovation, and Execution

A Proven Track Record in Finance, Innovation, and Execution

Justin Kirk

Co-Founding Contributor

• 25 Years Front End/UX Developer

• 20 Years Systems Architecture

• 8 Years Crypto Markets Trading

Justin Kirk

Co-Founding Contributor

• 25 Years Front End/UX Developer

• 20 Years Systems Architecture

• 8 Years Crypto Markets Trading

Justin Kirk

Co-Founding Contributor

• 25 Years Front End/UX Developer

• 20 Years Systems Architecture

• 8 Years Crypto Markets Trading

Michael Corbett

Co-Founding Contributor

• 30 Years Project Management

• 25 Years Efficiency Management

• 20 Years Change Management

Michael Corbett

Co-Founding Contributor

• 30 Years Project Management

• 25 Years Efficiency Management

• 20 Years Change Management

Michael Corbett

Co-Founding Contributor

• 30 Years Project Management

• 25 Years Efficiency Management

• 20 Years Change Management

Lynne Hamilton

Co-Founding Contributor

• 25 Years Intl. Gov Relations

• 20 Years Corporate Public Relations

• 20 Years Crisis Management

Lynne Hamilton

Co-Founding Contributor

• 25 Years Intl. Gov Relations

• 20 Years Corporate Public Relations

• 20 Years Crisis Management

Lynne Hamilton

Co-Founding Contributor

• 25 Years Intl. Gov Relations

• 20 Years Corporate Public Relations

• 20 Years Crisis Management

Stephan M. Houser

Co-Founding Contributor

• 15 Years Software Architecture

• 15 Years Tech. Exec. Management

• 10 Years Startups & Ventures

Stephan M. Houser

Co-Founding Contributor

• 25 Years Software Architecture

• 15 Years Tech. Exec. Management

• 10 Years Startups & Ventures

Stephan M. Houser

Co-Founding Contributor

• 15 Years Software Architecture

• 15 Years Tech. Exec. Management

• 10 Years Startups & Ventures

Wouter du Preez

Expert Contributor

• 30 Years Investment Banking

• 20 Years RWA Management

• 25 Years Structured Finance

Wouter du Preez

Expert Contributor

• 30 Years Investment Banking

• 20 Years RWA Management

• 25 Years Structured Finance

Wouter du Preez

Expert Contributor

• 30 Years Investment Banking

• 20 Years RWA Management

• 25 Years Structured Finance

Michael Loberg

Expert Contributor

• 30 Years Global Banking & Trusts

• 25 Years Corporate & Finance Litigation

• 25 Years Corporate Structuring

Michael Loberg

Expert Contributor

• 30 Years Global Banking & Trusts

• 25 Years Corporate & Finance Litigation

• 25 Years Corporate Structuring

Michael Loberg

Expert Contributor

• 30 Years Global Banking & Trusts

• 25 Years Corporate & Finance Litigation

• 25 Years Corporate Structuring

Paul Bolger

Expert Contributor

• 30 Years Securities and M&A

• 25 Years Corporate Finance

• 25 Years Corporate Structuring

Paul Bolger

Expert Contributor

• 30 Years Securities and M&A

• 25 Years Corporate Finance

• 25 Years Corporate Structuring

Paul Bolger

Expert Contributor

• 30 Years Securities and M&A

• 25 Years Corporate Finance

• 25 Years Corporate Structuring

Frequently

Frequently

Frequently

Asked Questions

Asked Questions

Asked Questions

Is this a trading platform?

Is this a managed capital Fund?

What are the expected Costs and Fees?

When will CipheX Alpha be available commercially?

Why would I use or trust this system?

Is this a trading platform?

Is this a managed capital Fund?

What are the expected Costs and Fees?

When will CipheX Alpha be available commercially?

Why would I use or trust this system?

Is this a trading platform?

Is this a managed capital Fund?

What are the expected Costs and Fees?

When will CipheX Alpha be available commercially?

Why would I use or trust this system?