Professional Investing

Made Simple

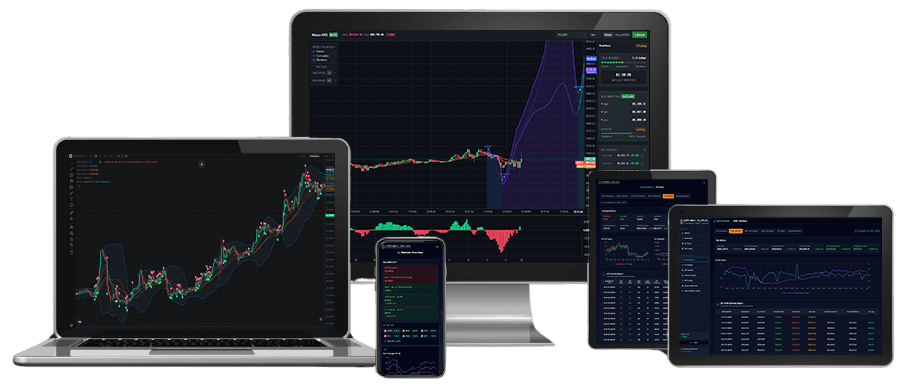

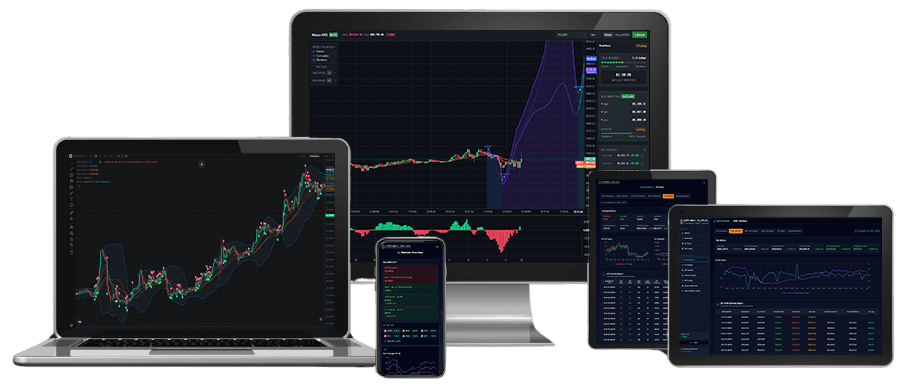

CipheX Alpha delivers professional investment intelligence through a simple, automated experience designed for everyday users, enabling confident self-management without added complexity.

Professional Investing

Made Simple

CipheX Alpha delivers professional investment intelligence through a simple, automated experience designed for everyday users, enabling confident self-management without added complexity.

Professional Investing

Made Simple

CipheX Alpha delivers professional investment intelligence through a simple, automated experience designed for everyday users, enabling confident self-management without added complexity.

CipheX Alpha is currently in precommercial testing and is not available to the general public. Commercial availability will be subject to applicable securities laws and regulations, and availability may be restricted or prohibited in certain jurisdictions.

CipheX Alpha is currently in precommercial testing and is not available to the general public. Commercial availability will be subject to applicable securities laws and regulations, and availability may be restricted or prohibited in certain jurisdictions.

CipheX Alpha is currently in precommercial testing and is not available to the general public. Commercial availability will be subject to applicable securities laws and regulations, and availability may be restricted or prohibited in certain jurisdictions.

Closing the Experience Gap

Closing the Experience Gap

Closing the Experience Gap

The digital asset market has matured into a high-velocity, globally integrated environment where execution, not access, defines competitive advantage. With rising complexity, heightened volatility, and increasingly narrow opportunity windows, conventional portfolio strategies are proving inadequate. In today’s 24/7 global market, sustained performance depends on executing with speed, strategic clarity, and precision.

Modern markets continue to evolve at an increasing speed. While consumer trading tools and self-directed portfolio platforms are widely available, most emphasize transaction activity rather than decision guidance and execution support. Many users also lack the time or experience required to manage their portfolios effectively. CipheX Alpha closes that gap by removing complexity and manual decision-making with automation driven by experience and strategies built for continuously changing global markets.

Modern markets continue to evolve at an increasing speed. While consumer trading tools and self-directed portfolio platforms are widely available, most emphasize transaction activity rather than decision guidance and execution support. Many users also lack the time or experience required to manage their portfolios effectively. CipheX Alpha closes that gap by removing complexity and manual decision-making with automation driven by experience and strategies built for continuously changing global markets.

Modern markets continue to evolve at an increasing speed. While consumer trading tools and self-directed portfolio platforms are widely available, most emphasize transaction activity rather than decision guidance and execution support. Many users also lack the time or experience required to manage their portfolios effectively. CipheX Alpha closes that gap by removing complexity and manual decision-making with automation driven by experience and strategies built for continuously changing global markets.

Designed for Simplicity

Designed for Simplicity

Designed for Simplicity

Alpha CPX preserves full user control while eliminating the inefficiencies of traditional portfolio management, human intermediaries, rigid fee structures, and biased execution. Powered by its proprietary CPX Targeting Framework, this non-custodial, self-directed system delivers autonomous, high-speed trading with institutional-grade performance, engineered to outperform both traditional managers and conventional self-directed platforms.

CipheX Alpha is engineered to operate autonomously with no manual trading required. It specializes in short-duration market opportunities, executing systematically through defined, process-driven frameworks that significantly reduce human intervention and eliminate emotion-driven execution risk. The result is a streamlined experience where users are not required to monitor markets, make constant decisions, or manage execution complexity.

CipheX Alpha is engineered to operate autonomously with no manual trading required. It specializes in short-duration market opportunities, executing systematically through defined, process-driven frameworks that significantly reduce human intervention and eliminate emotion-driven execution risk. The result is a streamlined experience where users are not required to monitor markets, make constant decisions, or manage execution complexity.

CipheX Alpha is engineered to operate autonomously with no manual trading required. It focuses on short-duration market opportunities, executing systematically through defined, process-driven frameworks that eliminate human intervention and emotion-driven execution risk. The result is a streamlined experience where users are not required to monitor markets, make constant decisions, or manage execution complexity.

Built to Adapt as Markets Change

Built to Adapt as Markets Change

Built to Adapt as Markets Change

Structured Targeting and Execution

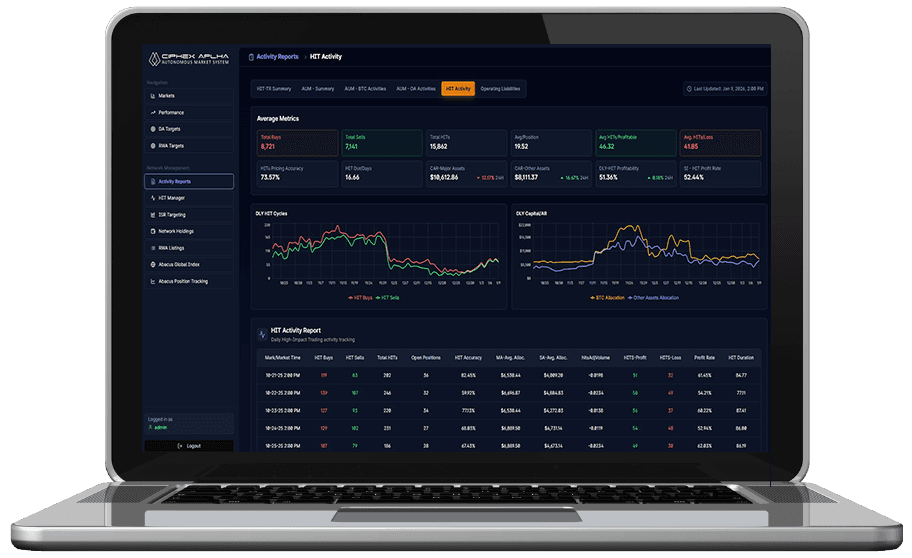

Built on the proprietary Abacus I AMS/EMS architecture, the system evaluates price dynamics and market inefficiencies across a broad digital asset universe. It generates market-condition-specific execution strategies applied over short-duration time horizons, using disciplined processes to convert continuous market shifts into consistent, probability-driven outcomes.

Structured Targeting and Execution

Built on the proprietary Abacus I AMS/EMS architecture, the system evaluates price dynamics and market inefficiencies across a broad digital asset universe. It generates market-condition-specific execution strategies applied over short-duration time horizons, using disciplined processes to convert continuous market shifts into consistent, probability-driven outcomes.

Structured Targeting and Execution

Built on the proprietary Abacus I AMS/EMS architecture, the system evaluates price dynamics and market inefficiencies across a broad digital asset universe. It generates market-condition-specific execution strategies applied over short-duration time horizons, using disciplined processes to convert continuous market shifts into consistent, probability-driven outcomes.

Adaptive Capital Allocation

The system identifies multiple opportunities simultaneously and applies strategies tailored to each. It systematically determines how much capital to commit at entry based on broader market conditions and asset-specific factors, maintaining disciplined position sizing and balanced portfolio allocation.

Adaptive Capital Allocation

The system identifies multiple opportunities simultaneously and applies strategies tailored to each. It systematically determines how much capital to commit at entry based on broader market conditions and asset-specific factors, maintaining disciplined position sizing and balanced portfolio allocation.

Adaptive Capital Allocation

The system identifies multiple opportunities simultaneously and applies strategies tailored to each. It systematically determines how much capital to commit at entry based on broader market conditions and asset-specific factors, maintaining disciplined position sizing and balanced portfolio allocation.

Responsive Risk Management

When markets shift suddenly or conditions change rapidly, the system prioritizes protecting capital. It adjusts positions by reducing risk exposure, shifting defensively, and controlling overall market sensitivity. These actions help contain losses more consistently and strengthen resilience during market downturns.

Responsive Risk Management

When markets shift suddenly or conditions change rapidly, the system prioritizes protecting capital. It adjusts positions by reducing risk exposure, shifting defensively, and controlling overall market sensitivity. These actions help contain losses more consistently and strengthen resilience during market downturns.

Responsive Risk Management

When markets shift suddenly or conditions change rapidly, the system prioritizes protecting capital. It adjusts positions by reducing risk exposure, shifting defensively, and controlling overall market sensitivity. These actions help contain losses more consistently and strengthen resilience during market downturns.

Designed for Confidence and Control

Designed for Confidence and Control

Designed for Confidence and Control

Built on principles of security and transparency, the system is designed to operate reliably across increasingly complex digital markets, including emerging tokenized real-world assets, while preserving user control. As markets evolve and traditional financial structures continue to change, CipheX Alpha reduces the burden of navigating complex markets by handling execution and risk dynamics in the background, allowing individuals to participate with greater confidence.

Built on principles of security and transparency, the system is designed to operate reliably across increasingly complex digital markets, including emerging tokenized real-world assets, while preserving user control. As markets evolve and traditional financial structures continue to change, CipheX Alpha reduces the burden of navigating complex markets by handling execution and risk dynamics in the background, allowing individuals to participate with greater confidence.

Built on principles of security and transparency, the system is designed to operate reliably across increasingly complex digital markets, including emerging tokenized real-world assets, while preserving user control. As markets evolve and traditional financial structures continue to change, CipheX Alpha reduces the burden of navigating complex markets by handling execution and risk dynamics in the background, allowing individuals to participate with greater confidence.

Execution Roadmap

Execution Roadmap

Execution Roadmap

A structured path from development to commercial deployment

A structured path from development to commercial deployment

Technical Audits

Completed

PHASE 1 Y2024

EMS Prototype Deployment

Completed

PHASE 2 Y2025

Introduce RWA Services

PHASE 3 TARGET- EY2026

Limited Public Presale

Completed

PHASE 1 Y2025

AMS/EMS PH II Optimization

Completed

PHASE 2 Y2025

Prototype Consumer Access

PHASE 3 TARGET- EY2026

Abacus Development

Completed

PHASE 1 Y2025

Initial DEX/CEX Listing

In Progress

PHASE 2 EY2026

V1. Consumer Launch

PHASE 3 TARGET- EY2026

Technical Audits

Completed

PHASE 1 Y2024

Abacus Development

Completed

PHASE 1 Y2025

Prototype Consumer Access

PHASE 3 TARGET- EY2026

Limited Public Presale

Completed

PHASE 1 Y2025

EMS Prototype Deployment

Completed

PHASE 2 Y2025

Introduce RWA Services

PHASE 3 TARGET- EY2026

AMS/EMS PH II Optimization

Completed

PHASE 2 Y2025

Initial DEX/CEX Listing

In Progress

PHASE 2 Y2026

V1. Consumer Launch

PHASE 3 TARGET- EY2026

Technical Audits

Completed

PHASE 1 Y2024

Limited Public Presale

Completed

PHASE 1 Y2025

AMS/EMS PH II Optimization

Completed

PHASE 2 Y2025

Abacus Development

Completed

PHASE 1 Y2025

EMS Prototype Deployment

Completed

PHASE 2 Y2025

Initial DEX/CEX Listing

In Progress

PHASE 2 EY2026

Prototype Consumer Access

PHASE 3 TARGET- EY2026

Introduce RWA Services

PHASE 3 TARGET- EY2026

V1. Consumer Launch

PHASE 3 TARGET- EY2026

DEVELOPMENT

COMMERCIALIZATION

OPTIMIZATION

Abacus I AMS/EMS Development Roadmap

ABACUS I AMS/EMS

Development Roadmap

Abacus I AMS/EMS Development Roadmap

Updated January 05, 2026

Updated January 05, 2026

Phase I

Abacus EMS IP / POC

Abacus EMS IP / POC

PH-I Completed May 2025

DA Targeting Framework

IP Completed August 2023

DA Market Probability Model

IP Completed May 2024

EMS Prototype Development

Completed April 2025

EMS Live Market Optimization

Deployed May 2025

EMS Prototype Test Deployment

Completed May 2025

Phase II

Abacus AMS / EMS

Abacus AMS / EMS

PH-II Completed December 2025

AMS Prototype Development

Completed July 2025

AMS Live Market Integration

Completed August 2025

AMS/EMS I System Integration

Completed September 2025

AMS/EMS Phase II Optimization

Completed December 2025

AMS/EMS Market Optimization

Started October 2025

Phase III

Abacus AMS / EMS

Abacus AMS / EMS

PH-III Start January 2026

Expand Risk Management

In Progress 2026

Expand Signals Framework

In Progress 2026

RWA Market Framework

In Progress 2026

Expand AMS-AUM Framework

In Progress 2026

Phase IV

Abacus AMS / EMS

Abacus AMS / EMS

PH-IV Start TBD 2026

Prototype Consumer Development

Started December 2025

Internal Consumer Access Testing

Start TBD 2026

Live Consumer Optimization

Start TBD

Perspectives that Built Our Architecture

Perspectives that Built Our Architecture

Perspectives that Built Our Architecture

Direct insights from expert contributors on the intelligence, framework, and governance behind CipheX Alpha.

Direct insights from expert contributors on the intelligence, framework, and governance behind CipheX Alpha.

Leadership & Expert Contributors

Leadership & Expert Contributors

Leadership & Expert Contributors

A Proven Track Record in Finance, Innovation, and Execution

A Proven Track Record in Finance, Innovation, and Execution

A Proven Track Record in Finance, Innovation, and Execution

Justin Kirk

Co-Founding Contributor

• 25 Years Front End/UX Developer

• 20 Years Systems Architecture

• 8 Years Crypto Markets Trading

Justin Kirk

Co-Founding Contributor

• 25 Years Front End/UX Developer

• 20 Years Systems Architecture

• 8 Years Crypto Markets Trading

Michael Corbett

Co-Founding Contributor

• 30 Years Project Management

• 25 Years Efficiency Management

• 20 Years Change Management

Michael Corbett

Co-Founding Contributor

• 30 Years Project Management

• 25 Years Efficiency Management

• 20 Years Change Management

Lynne Hamilton

Co-Founding Contributor

• 25 Years Intl. Gov Relations

• 20 Years Corporate Public Relations

• 20 Years Crisis Management

Lynne Hamilton

Co-Founding Contributor

• 25 Years Intl. Gov Relations

• 20 Years Corporate Public Relations

• 20 Years Crisis Management

Stephan M. Houser

Co-Founding Contributor

• 15 Years Software Architecture

• 15 Years Tech. Exec. Management

• 10 Years Startups & Ventures

Stephan M. Houser

Co-Founding Contributor

• 25 Years Software Architecture

• 15 Years Tech. Exec. Management

• 10 Years Startups & Ventures

Wouter du Preez

Expert Contributor

• 30 Years Investment Banking

• 20 Years RWA Management

• 25 Years Structured Finance

Wouter du Preez

Expert Contributor

• 30 Years Investment Banking

• 20 Years RWA Management

• 25 Years Structured Finance

Michael Loberg

Expert Contributor

• 30 Years Global Banking & Trusts

• 25 Years Corporate & Finance Litigation

• 25 Years Corporate Structuring

Michael Loberg

Expert Contributor

• 30 Years Global Banking & Trusts

• 25 Years Corporate & Finance Litigation

• 25 Years Corporate Structuring

Paul Bolger

Expert Contributor

• 30 Years Securities and M&A

• 25 Years Corporate Finance

• 25 Years Corporate Structuring

Paul Bolger

Expert Contributor

• 30 Years Securities and M&A

• 25 Years Corporate Finance

• 25 Years Corporate Structuring

Frequently

Frequently

Frequently

Asked Questions

Asked Questions

Asked Questions

Is this a trading platform?

Is this a managed capital Fund?

What are the expected Costs and Fees?

When will CipheX Alpha be available commercially?

Why would I use or trust this system?

Is this a trading platform?

Is this a managed capital Fund?

What are the expected Costs and Fees?

When will CipheX Alpha be available commercially?

Why would I use or trust this system?

Is this a trading platform?

Is this a managed capital Fund?

What are the expected Costs and Fees?

When will CipheX Alpha be available commercially?

Why would I use or trust this system?